Brands sponsor the Premier League for its immense global popularity, extensive content opportunities both on and off the field, credibility enhancement, and unmatched digital reach.

Traditionally, brands in Old Economy sectors such as financial services, airlines, and car manufacturers have invested the greatest marketing dollars into the Premier League. However, their share of voice is thinning.

This insights piece dives into the Premier League’s shifting brand landscape, highlighting the rise of the New Economy sector – a sector characterised by innovation, technology dependence, and rapid growth.

The Premier League’s shifting brand landscape

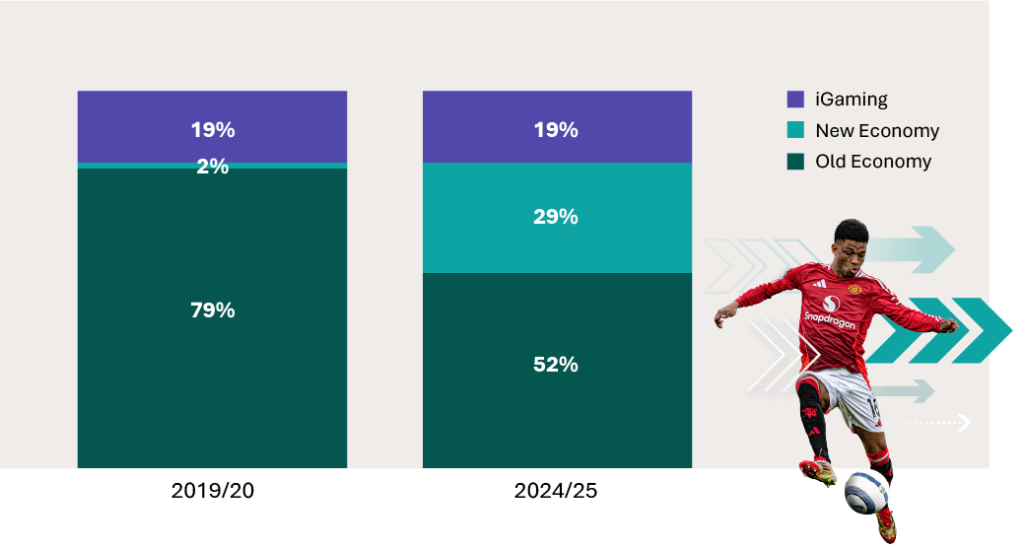

Since pre-Covid (2019/20 – 2024/25), Old Economy brand spend on team deals has declined by 5% – while New Economy brands nearly quadrupled spend from $90m per year to over $350m.

Premier League team spend by economy type:

(excludes kit supplier deals)

This shift is being driven by multiple industries on both sides:

Changes in Premier League spend 2024/25 vs 2019/20:

(Old Economy top five decline, New Economy top five increase)

The steepest declines (Automotive, Tyres) and increases (Crypto currency, IT & Services) in sector spend can be attributed to activity in the major uniform deals market (which accounted for 62% of team Premier League spend for 2024/25). *Kit supplier deals not included.

High-profile partnerships from Old Economy brands like Chevrolet with Manchester United and Yokohama Tyres with Chelsea, came to an end and haven’t been replaced. Neither by the original sponsors nor new entrants from the automotive or tyre industries.

Meanwhile, Manchester United’s front of shirt has since been from the expanding New Economy Sector in the form of IT & Services brands TeamViewer and subsequently Snapdragon. Additionally, Cryptocurrency brands OKX (Manchester City sleeve), Tezos (Manchester United Training), Kraken (Tottenham Hotspur sleeve) and BingX (Chelsea Training) boasted major uniform positions for the 2024/25 season.

In all, the percentage spend on Premier League uniform deals by New Economy brands over the last five seasons has increased from 2% to 29%. Over the same time-period, Old Economy share of uniform spend has declined from 79% to 52%.

Percentage total Premier League uniform spend by economy type:

New Economy sponsorship in the Premier League isn’t a one-size-fits-all trend, with investment from over 100 brands across 20 sectors.

For finance-focused New Economy sectors like Crypto, Online Trading and Fintech – the Premier League’s global audience and strong financial performance make it a natural fit. For tech-focused challengers in industries such as IT, Travel and Sport / Health, the Premier League offers a dynamic platform to showcase their cutting-edge solutions and connect with a digitally-savvy, global audience hungry for the latest trends.

Premier League team spend by New Economy sector – 2024/25 season:

(top ten spenders only)

What’s next?

The Premier League is currently preparing to ban teams from displaying betting brands on front of shirts from the 2026/27 season.

With the exit of many Premier League shirt sponsors, a new opportunity may emerge for brands. Premier League front-of-shirt sponsorship is a thinly traded marketplace, with only four to five teams per season. But with availability doubling and the biggest buyer exiting, simple supply and demand economics suggest the market is likely to be softer year-on-year, presenting a buying opportunity for non-betting brands.

Looking to learn more about Premier League sponsorship opportunities in your brand sector?

We help brands create winning partnerships with the biggest names in sport, enabling them to grow brand awareness, build credibility and deliver impactful results.

At SportQuake, we bring together data from across the entire sports eco-system providing intelligence into what your target audience is doing, watching and engaging with, as well as looking at the moves your competitors are making.

Get in touch with the SportQuake team to learn more.