Brands sponsor the Premier League for its immense global popularity, extensive content opportunities both on and off the field, credibility enhancement, and unmatched digital reach.

Traditionally, brands in Old Economy sectors such as financial services, airlines, and car manufacturers have invested the greatest marketing dollars into the Premier League. However, their share of voice is thinning.

This Insights piece dives into the Premier League’s shifting brand landscape, highlighting the rise of the New Economy sector – a sector characterised by innovation, technology dependence, and rapid growth.

The shift towards New Economy

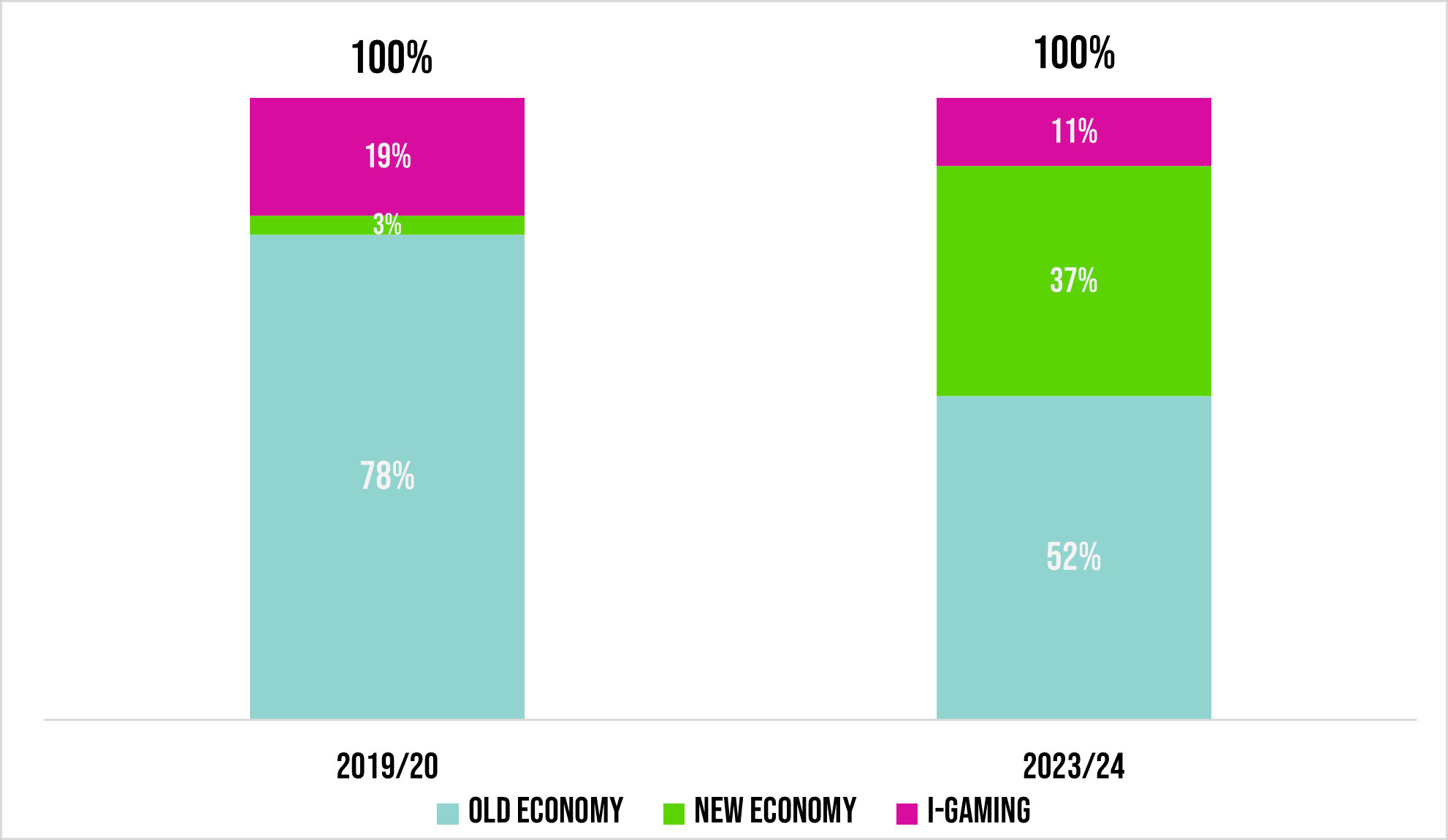

Over the past five seasons (2019/20 – 2023/24), Old Economy brand spend declined by 20%. Conversely, New Economy brands quadrupled spend from £77m per year to over £300m.

Premier League Spend | Old Economy, I-Gaming, New Economy

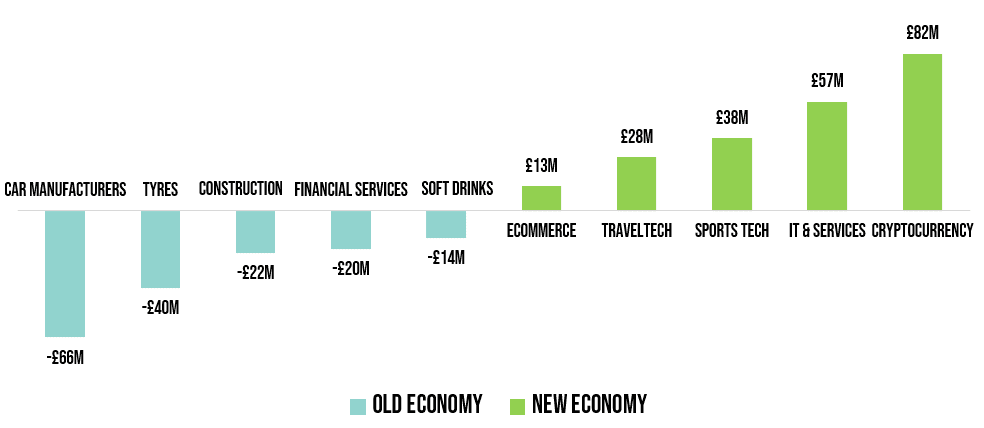

This phenomenon is being driven by multiple industries on both sides:

Change in Premier League Spend | 2023/24 vs 2019/20 | By Industry | Old Economy Top Five Decline, New Economy Top Five Increase

The steepest declines (car manufacturer, tyres) and increases (Cryptocurrency, IT & Services, Sports Tech) in sector spend can be attributed to activity in the major uniform deals market (which accounted for 60% of total Premier League spend for 23/24).

High-profile partnerships from Old Economy brands like Chevrolet with Manchester United and Yokohama Tyres with Chelsea, came to an end and haven’t been replaced. Neither by the original sponsors nor new entrants from the automotive or tire industries.

Meanwhile, both the Manchester United and Chelsea front-of-shirts for the 2023/24 season are from the burgeoning New Economy sector in the form of IT & Services brand TeamViewer (Manchester United) and Sports Tech brand Infinite Athlete (Chelsea). Additionally, Cryptocurrency brands OKX (Manchester City sleeve), Tezos (Manchester United Training), and BingX (Chelsea sleeve) boasted major kit positions for the 2023/24 season.

In all, the percentage spend on Premier League uniform deals by New Economy brands over the last five seasons has increased from 3% to 37%. Over the same time-period, Old Economy share of uniform spend has declined from 78% to 52%.

% total Premier League uniform spend | By Economy type

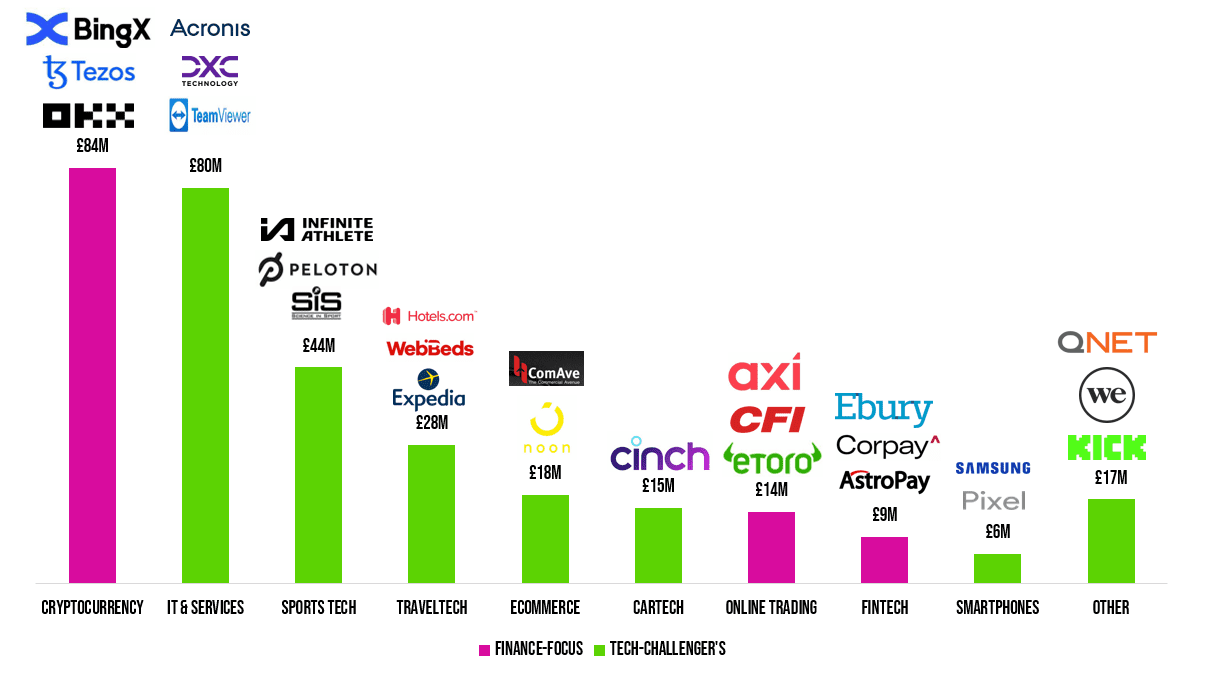

New Economy sponsorship in the Premier League isn’t a one-size-fits-all phenomenon, with investment from over 100 brands across 20 sectors

For finance-focused New Economy sectors like Crypto, Online Trading and Fintech – the Premier League’s global audience and strong financial performance make it a natural fit. For tech-focused challengers in industries such as Information Technology, Travel and Sport / Health, the Premier League offers a dynamic platform to showcase their cutting-edge solutions and connect with a digitally-savvy, global audience hungry for the latest trends.

Premier League Spend | By New-Economy Sector | 2023/24 Season | Top Ten Spenders Only

Looking to learn more about Premier League sponsorship opportunities in your brand sector? Get in touch with the SportQuake team.

We work across all Premier League properties, all inventory and have deep understanding around sponsorship effectiveness and pricing. We help brands of all sizes navigate this complex sponsorship ecosystem to create the ultimate Premier League strategy to achieve their goals.